Foreign Relations Committee

United States Senate

Keystone XL and the National Interest Determination

Testimony of Hon. Karen A. Harbert President & CEO

Institute for 21st Century Energy U.S. Chamber of Commerce

Thursday, March 13, 2014

Thank you Chairman Menendez, Ranking Member Corker, and members of the Committee. I am Karen Harbert, president and CEO of the Institute for 21st Century Energy (Institute), an affiliate of the U.S. Chamber of Commerce, the world’s largest business federation representing the interests of more than three million businesses of all sizes, sectors, and regions, as well as state and local chambers and industry associations, and dedicated to promoting, protecting, and defending America’s free enterprise system.

The mission of the Institute is to unify policymakers, regulators, business leaders, and the American public behind a common sense energy strategy to help keep America secure, prosperous, and clean. In that regard we hope to be of service to this Committee, this Congress as a whole, and the administration.

Introduction: The Strategic Context

According to the Energy Information Administration (EIA), fossil fuels will remain the largest energy source worldwide for decades into the future. As the global economy recovers and developing economies continue to rapidly expand, demand for energy will increase by as much at 56% by 2040, and competition for petroleum and all forms of energy will increase throughout the world.

Through the application of new technologies, North America is moving from an era of energy resource scarcity to one marked by energy abundance. Indeed, the core assumption underlying our energy policy—scarcity—is no longer valid. North America has the largest fossil fuel resource base in the world.

This has caused a shifting in the world’s energy center of gravity from the Middle East to North America. The rapid change in U.S. and Canadian energy fortunes has caught many analysts and policymakers by surprise. Many experts now believe energy self reliance for North America actually may be within reach in the coming decade.

Nevertheless, forecasts agree that the United States will continue to be a net importer of oil for many years to come. EIA’s Annual Energy Outlook 2014 Early Release, for example, projects that U.S. consumption of petroleum and other liquids will peak around 2020 at 19.5 MMbbl/d and decline gently thereafter. EIA also projects that crude oil production will approach 9.6 MMbbl/d by 2020. As a result of these two trends, net crude oil imports have declined from 60% of total crude oil supply in 2011 to less than 50% today, and they are projected to decline further to 40% by 2020. As the United States remains a net importer of crude oil, he greater access to Canadian crude oil afforded by Keystone XL would increase the reliability and the diversity of foreign supplies of crude oil the U.S. will continue to need.

America needs sustained economic growth. The economy continues to expand at a slow pace, and unemployment remains stubbornly high. North America’s abundant energy resources provide a readily available mechanism to ensure affordable energy, grow our economy, create millions of well-paying jobs, and strengthen our nation’s long-term energy security. We have the largest stimulus package available to our economy in the form of energy, and this economic injection is not one that is borne by the American taxpayer.

In 2002, North American proved reserves accounted for about 5% of the world total. The following year, the addition of 175 billion barrels of oil from Canada’s oil sands to proved reserves boosted North America’s reserves to 215 billion barrels and its share of proved global reserves to 18%. In a recent report,[1] EIA estimates that in 2013—10 years later—technically recoverable resources of unproved conventional and shale oil resources could be as high as 594 billion barrels, triple the 2003 estimate. Rapidly improving technology could send this estimate even higher. When combined with the estimated 2 trillion barrels of U.S. oil shale and oil sand resources, North America’s crude oil resource is greater than the amount of proved conventional reserves in the rest of the world today. The region can be an energy superpower if we let it.

Canada has doubled its oil production over the last two decades and sends almost all of its oil exports to the United States (though with new outlets for Canadian crude oil in the works, that will change). Production from the Alberta oil sands can increase from the current 1.4 MMbbl/d to more than 3.5 MMbbl/d by 2025, and some estimates are higher still. This represents crude oil that we will not need to import from OPEC nations. Much of the Canadian crude is supplied to the U.S. through nineteen cross-border pipelines, which received permits under both Republican and Democratic presidents, including President Obama.

Canada is an important and reliable trading partner and is by far the largest supplier of oil and natural gas to the United States, supplying 16% of U.S. petroleum consumption needs and 28% of U.S. petroleum imports. Stable, long-term energy supplies from Canada are critical to U.S. energy security at a time when global supplies are often found in geopolitically unstable regions of the world and production from once-reliable sources is slowing.

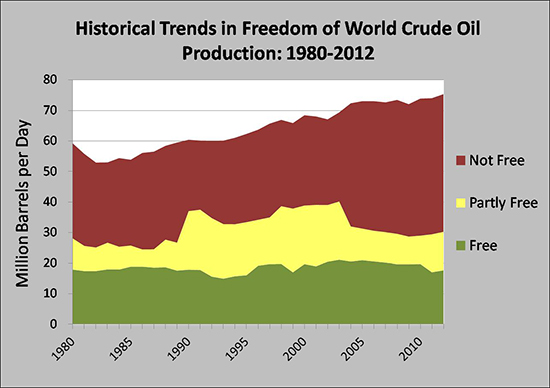

The Institute has taken a close look at energy supply issues and how they impact U.S. and international energy security as part of our Index of U.S. Energy Security Risk and International Index of Energy Security Risk studies. One way to look at supply risk is to measure how much of the global oil supply is in the hands of potentially politically unstable countries. This was done using Freedom House rankings of civil and political liberties, which the group uses to categorize countries as Free, Partly Free, and Not Free (Figure 1). The chart shows that since 1980, output from Not Free and Partly Free countries has increased while output from Free countries has been stuck in a range of 17 to 20 million barrels per day. As a result, the share of global production in Not Free and Partly Free countries climbed from a low of 65% in 1985 to a high of 77% in 2012. At a time when North Sea oil output is falling, large emerging economies are growing into large oil consumers, putting pressure on spare oil production capacity globally. Potential political instability in many producing countries is also on the rise, and greater output from a close friend and ally like Canada is needed and welcome.

Figure 1.

Figure 1.

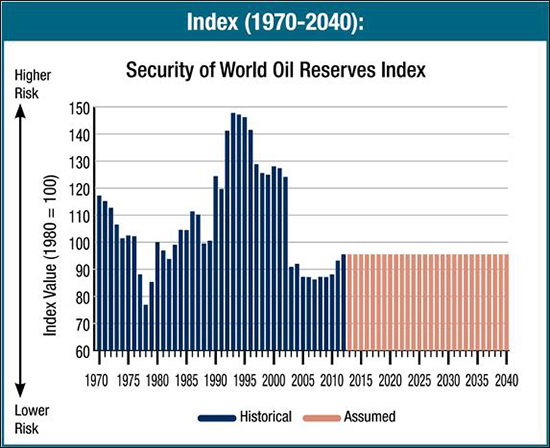

Taking this analysis a step further, the Institute has developed metrics of global supply risks for oil, natural gas, and coal reserves and supplies that combine measures of reliability (using Freedom House rankings as a proxy) and market diversity. Diversity of supply is a key aspect of energy security—the greater the supply diversity, the lower the supply risk.

Of particular relevance to this discussion is the global crude oil proved reserves risk metric shown below (Figure 2). It shows a sharp increase in global supply risks in the early to mid-1990s because of increases in reserves being listed for Iran, Iraq, Saudi Arabia, United Arab Emirates, and Venezuela. The stunning plunge in global risk observed in 2003 is entirely due to the listing of an additional 175 billion barrels of crude reported for Canada.

Figure 2.

Figure 2.

Both of these charts demonstrate energy supplies from reliable trading countries such as Canada can lower energy security risks for the United States and other countries. Therefore, the construction of TransCanada’s Keystone XL pipeline will help us lower our energy security risk while also realizing the economic and energy security benefits of Canadian and U.S. resources.

Economic Benefits

We believe it is clearly in the national interest that TransCanada’s Keystone XL (KXL) pipeline project proceeds. TransCanada’s Keystone XL pipeline is a $3.3 billion pipeline expansion project that would increase the existing Keystone Pipeline system that connects Canada’s 175 billion barrel oil sands resource to U.S. refining centers from a capacity of 591,000 bbl/d to more than 1.2 MMbbl/d.

The economic impact and long term benefits of the construction of the KXL pipeline are significant and vitally important to American jobs and our economy, especially during this time of sluggish economic growth. According to the Department of State’s Final Supplemental Environmental Impact Statement (January, 2014), 42,100 Americans will be employed in direct, indirect, and induced jobs during construction of Keystone XL, generating $2.02 billion in earnings for workers. In addition, the FSEIS reported that the project will generate $66 million in sales tax for goods and services during construction that will infuse economic vitality into local communities. Overall, the Keystone XL project will contribute $3.4 billion during construction to the U.S. Gross Domestic Product (FSEIS, January 2014).

Keystone also will enhance an already deep trading relationship. It is estimated that for every $1.00 spent to buy oil from Canada, $0.89 is returned in the purchase of U.S. goods or services. The development of Canadian oil sands resources already supports tens of thousands of American workers in hundreds of companies spread throughout the Unites States who are supplying goods and services to oil sands developers. The approval of the Keystone XL pipeline will help allow for the continued growth in development of the oil sands and an increased flow of trade between the U.S. and Canada.

Once the pipeline is built, TransCanada will become one of the single largest property taxpayers in Montana, South Dakota, and Nebraska. During construction of the pipeline, TransCanada will pay $55.6 million in property taxes to states and local communities in counties with Keystone facilities (FSEIS, January 2014). This revenue will help support key local services like schools and fire and police services, as well as needed projects like roads, bridges, recreation facilities, and new schools—thus helping create and support additional construction jobs and economic benefits.

In addition to these economic benefits, expansion of the Keystone XL pipeline would enhance U.S. energy security. Linkages to the pipeline system also could enable crude oil production from the Bakken formation and, if they are allowed to be developed, oil shale formations in Wyoming to be transported to refineries in the Gulf region more efficiently.

The failure of the federal government thus far to grant a construction permit for the Keystone XL pipeline exemplifies perhaps better than anything the challenges of building energy projects and the need for common sense energy policy reform in the United States.

Foreign Relations and Trade

After over five years of environmental and other reviews, the portion of the northern section of the pipeline from the Canadian border to Steele City, Nebraska, is still awaiting presidential approval. Some have called this the most studied piece of US infrastructure ever. The Prime Minster of Canada called the project a “no-brainer.” And leaders, investors, and markets have been watching. This failure has tarnished America’s image as a “can do” country open to investment, a failure that can be difficult to shake from investors’ minds.

Also, while the Keystone XL proposal has been under consideration and delayed, Canadian oil sands developers have been looking to countries other than the U.S., such as China and India, as markets for oil sands crude. Proposals have been developed and accelerated to build pipelines that would stay within Canadian borders, running west from Alberta to the Pacific Coast, and move crude to markets in the East.

Reliable, long-term energy supplies from Canada are critical to U.S. energy security at a time when global supplies are often found in geopolitically unstable regions of the world and in countries that aren’t concerned with U.S. best interests. While expansion of U.S. domestic energy sources must remain a top priority, imported oil will continue to play a key role in meeting energy demand, and oil from Canada can help meet our supply and demand challenges.

The increased supply of crude oil from KXL would greatly contribute to our move toward North American energy self-sufficiency. U.S. refineries in the Gulf Coast rely mostly on foreign imports of heavy crude oil. When completed, the KXL pipeline will have the capacity to supply over 800,000 barrels per day of crude oil from Canada and the U.S. Bakken region to U.S. refineries, curbing dependency on crude oils from Venezuela and Mexico, whose volumes of crude exports are in decline, and less stable countries in the Middle East and Africa.

It is critical to reiterate that Canada is an important and reliable trading partner for the U.S. These two nations already enjoy the largest trading partnership across the longest peaceful border in the world. In addition, the approval of the Keystone XL pipeline would result in an increased flow of trade between the U.S. and Canada. For every U.S. dollar spent on Canadian products, Canadians return 89 cents through the purchase of U.S. goods and services. Compared to the 27 cent return that we get from energy trade partners like Venezuela, the benefits of Canadian trade are obvious, as are the energy security advantages.

Finally, during the five-plus year period that the project has been under review, America has been sending billions of dollars overseas to purchase oil from countries that are not our allies. It just doesn’t make sense.

Environmental Goals and Objectives

The Keystone XL project is a “win-win” for the United States. The FSEIS (January, 2014) found that the project will have “limited adverse environmental impacts” during construction and operation. It will help provide an important source of energy for our nation, boosting our economy and improving our energy security by reducing our dependence on oil from overseas.

According to EIA (2013), U.S. energy related emissions of carbon dioxide fell are at their lowest level since 1994. While Canada is committed to developing its oil sands resources, it is also steadfast in its efforts to reduce its greenhouse gas (GHG) emissions and has made great strides in cutting emissions from oil sands. According to the Canadian government, technological advancements have cut per-barrel GHG emissions from oil sands production by 26% compared to 1990 levels. Oil from the oil sands is destined to reach the U.S. and our refineries. Efforts to stop crude transportation projects like KXL will have no impact on the development of oil sands. The recently released FSEIS states that approval or denial of any one crude oil transport project is unlikely to significantly impact the rate of extraction in the oil sands or the continued demand for heavy crude oil at refineries in the U.S.

The FSEIS also states that KXL will produce 28% – 42% less GHG emissions than any other possible alternative oil sands transportation scenarios, adding additional benefit for the environment.

The Department of State has conducted a comprehensive, extensive, and thorough independent environmental review. Multiple federal, state, and local agencies have been involved, and opportunities for public input were provided throughout the process. Any further reviews or delays are unnecessary and unwarranted.

Conclusion

The Keystone XL pipeline has called attention to a much larger problem in America. The good news is that over the last five years the world’s energy center of gravity has shifted closer to North America. The alarming news is that our energy policy has lagged far behind this reality and is now standing squarely in the way of realizing a more competitive and secure energy future for America. The question is on the table: “Is America open for business?”

As a nation, we have been blessed with abundant natural resources and a great capacity for technological innovation. Fulfilling America’s energy potential requires strategic thinking underpinned by durable policy. For too long, our approach to energy has been conflicted, contradictory, and myopic. The extraordinary opportunities being created in U.S. energy today have come about despite government policy, not because of it. That has to change if we are to energize the economy and put people back to work, and that means approving needed energy infrastructure, like the Keystone XL pipeline, in a timely manner.

If done right, energy can be a potent driver for our nation’s economic recovery. We can choose to seize the new opportunities being created across America’s energy landscape or simply cede these potential advantages to other countries.

The Energy Institute believes that unleashing the power of free markets to create a competitive energy marketplace will stimulate economic activity and create jobs. The majority of the Keystone XL project has been under review for over five years, taking into consideration comments and information collected through multiple hearings, comment periods, and interagency processes. Public citizens, governments, Tribal governments, and non-governmental organizations have all taken part in the review process. A new scientific poll shows that 65% of Americans support this pipeline. There is no doubt that the oil sands in Alberta will be developed, and the only question is where the oil will go. America has a choice of getting more oil from its trusted ally Canada and in the process increasing revenue and investments in the U.S. or sending more of our hard earned money to unfriendly or unreliable countries.

Approving the Keystone XL pipeline and making energy infrastructure a priority will put America on a long-term path to a safe, strong, prosperous, and clean energy future. It is more than past time to move forward and grant the Presidential Permit to allow construction on the pipeline to begin.

[1] EIA. 2013. Technically Recoverable Shale Oil and Shale Gas Resources: An Assessment of 137 Shale Formations in 41 Countries Outside the United States. Available at: https://www.eia.gov/analysis/studies/worldshalegas/.